MFin in Spain: Top Colleges, Career Opportunities & More

MFin in Spain: Top Colleges, Career Opportunities & MoreThinking about pursuing a …

Table of Contents

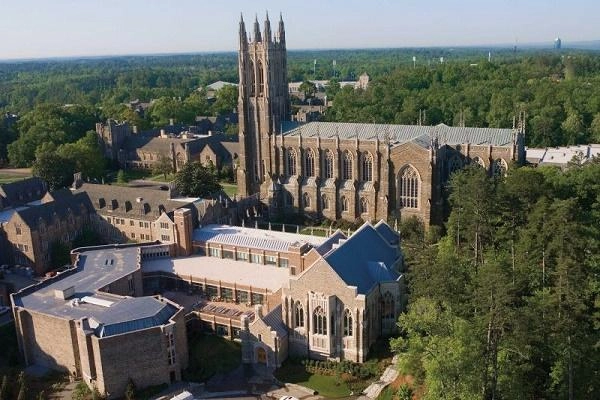

Thinking about a career in finance? The Duke Master of Science in Finance (MSF) program might be a great choice! It is offered by the Fuqua School of Business and is one of the best finance programs in the U.S.

Whether you want to work in investment banking, asset management, or financial consulting, this program can help you get there.

Duke is a top-ranked university in the U.S. and worldwide. Let’s see how its MS in Finance program compares to others:

Ranking | Organization | Position |

| Best U.S. Business Schools | U.S. News & World Report | Top 15 |

| Global University Ranking | QS World Rankings | Top 50 |

| Finance Program in the U.S. | Financial Times | Top 10 |

Duke competes with some of the best MS in Finance programs in the world. Here’s a quick comparison:

University | MS in Finance Rank | Program Duration | STEM-Designated |

| MIT (Sloan) | #1 | 12 months | ✅ Yes |

| Princeton | Top 5 | 10 months | ✅ Yes |

| Duke (Fuqua) | Top 10 | 10 months | ✅ Yes |

| NYU (Stern) | Top 10 | 12 months | ✅ Yes |

Duke MSF is one of the best finance programs in the country, competing with top schools like MIT, Princeton, and NYU.

The Duke MS in Finance (MSF) program has a strong curriculum that helps students learn important financial skills. It includes core courses, electives, and research opportunities that prepare students for real-world finance jobs.

The program covers important finance topics that are useful in the industry. Here are some of the key courses:

Core Course | What It Covers |

| Corporate Finance | How companies make financial decisions |

| Investment Analysis | How to analyze stocks and bonds |

| Financial Modeling | Building financial models using Excel |

| Derivatives | Understanding options, futures, and risk management |

| Financial Accounting | Learning how to read financial statements |

These courses give students a strong foundation in finance, helping them succeed in careers like investment banking, asset management, and risk analysis.

Students can choose electives based on their interests. Some of the popular specialization areas include:

This customized learning helps students build skills for specific finance jobs.

Duke’s Financial Economics Center (DFEC) gives students hands-on experience in finance. Students can:

This helps students apply their classroom knowledge to real finance problems and gain valuable experience.

Duke’s MS in Finance program brings together students from different backgrounds. Here’s a breakdown of the class profile:

Category | Details |

| Class Size | Around 100 students |

| International Students | 50%+ from different countries |

| Gender Ratio | About 40% women, 60% men |

| Work Experience | 0-2 years (some fresh graduates, some with internships) |

| Academic Background | Finance, Economics, Engineering, Mathematics |

This mix of students makes the program diverse and globally focused.

Duke’s Fuqua School of Business offers an exciting student life! Students can:

This strong network helps students make connections, learn from experts, and land great jobs after graduation.

Studying at Duke is a big investment, so it’s important to know the costs. Here’s a breakdown of the estimated expenses:

Expense | Estimated Cost (per year) |

| Tuition | $65,000 – $70,000 |

| Living Expenses | $20,000 – $25,000 |

| Books & Supplies | $2,000 |

| Health Insurance | $3,500 |

| Other Fees | $2,000 – $3,000 |

Total estimated cost: $90,000 – $100,000 per year (including tuition and living expenses).

Duke offers several scholarships and financial aid options for students.

Merit-Based Scholarships – Awarded to students with strong academic and leadership skills.

Need-Based Scholarships – Available for students who need financial support.

Diversity Scholarships – Encourages students from different backgrounds to apply.

Both domestic and international students can apply for these scholarships. Many students also take student loans or assistantships to help cover costs.

Graduates from Duke’s MSF program get great job opportunities! Here’s a look at post-graduation salaries and job placement:

Category | Details |

| Employment Rate | 95%+ within 6 months of graduation |

| Average Salary | $90,000 – $110,000 per year |

| Bonus & Incentives | Up to $20,000 |

Most students receive job offers before they graduate, thanks to Duke’s strong career support and alumni network.

Duke MSF graduates work in top finance industries such as:

Investment Banking – Mergers & Acquisitions, Financial Advisory

Asset Management – Portfolio Management, Wealth Advisory

Consulting – Financial Strategy, Risk Analysis

FinTech – Digital Banking, Blockchain, AI in Finance

Some of the world’s best finance companies hire from Duke:

Goldman Sachs, Morgan Stanley, JPMorgan Chase

BlackRock, Citadel, Vanguard

McKinsey, Boston Consulting Group (BCG), Deloitte

These companies offer high-paying jobs and career growth opportunities for Duke MSF graduates.

To apply for Duke's MMS program, applicants should meet the following criteria:

Duke's MMS program offers multiple application rounds. It's advisable to apply early, especially for international applicants requiring visas. The upcoming deadlines are:

International students needing an F-1 visa are encouraged to apply by Round 2 to ensure timely processing.

The application includes several short-answer questions and essays designed to understand your motivations and goals. Applicants are required to respond to three short-answer questions (maximum 500 characters each) and two longer essays. The specific essay prompts may vary each application cycle.

Tips for Writing Essays:

Interviews are conducted by invitation after an initial review of application materials. They are typically held via video conference, though North Carolina residents may have the opportunity for on-campus interviews.

Common Interview Questions:

Preparation Strategies:

Duke does not have a specific Master of Science in Finance (MSF) program. However, it offers several finance-related programs with strong career opportunities.